|

MORE INFORMATION AND REGISTRATION | SPONSORSHIP OPPORTUNITIES

March 4 - March 5 - March 6

*Updated 2/23/2024 - Subject to Change*

Monday, March 4th

|

5:00 pm – 7:00 pm

Room: Rodrigue Gallery on the 1st floor (next to the Fed Ex Business Center)

|

Welcome Reception -Drinks & Appetizers

|

|

7:00 pm

|

Dedicated Time - Client dinners and entertainment

|

Tuesday, March 5th

|

7:30 am – 8:30 am

Room: Lagniappe

|

Breakfast

Sponsored by:

|

|

8:45 am – 10:15 am

Room: Waterbury

|

Welcome and Keynote Session

Keynote Speaker: Chad Porter, Inspiring A Better You.

Chad Porter is one of the nation's most inspirational and motivational speakers. He has been speaking for over 20 years, telling his amazing story of overcoming obstacles, perseverance, and dealing with life's challenges while inspiring hundreds of thousands in the process.

|

|

10:15 am – 10:30 am

Room: Waterbury Foyer

|

Refreshment Break

|

|

10:30 am – 11:15 am

Rooms: Rhythm 1-3

|

Breakout Sessions – Choose One

Session #1: Collections is also a customer experience - a fireside chat with TransUnion & T-Mobile

With COVID, rising delinquency and the evolution of regulations, Collection practices have needed to pivot quickly! The fireside chat will include how to think about collections during on-boarding and collecting with new regulations.

Learning Objective:

- Pivoting and being successful in the collection space with regulations

Speakers: Debra Kammer, VP Sales at TransUnion; Michael Cardinal, Senior Manager of Collections at T-Mobile

Room: Rhythm 1

|

|

Session #2: AI = Real responsibility: How to ensure your customers and company aren’t at risk

Is AI helping or hindering your company's ability to protect your customers and meet their needs? The possibilities with AI are endless, but regulators are raising the stakes by holding companies accountable for using it responsibly. Join Ron Lo, a legal professional with over a decade of experience working with tech companies and tech enabled businesses, to find out how you can leverage AI while ensuring you’re not putting your business and customers at risk.

Learning Objectives:

- Despite its many utilities and functions, what data privacy problems and risks can arise when using AI?

- What solutions are being proposed? Are those solutions truly able to address the shortcomings of AI, or is AI inherently problematic?

- As regulations for AI increase, how can companies embrace the power of AI within these regulatory constraints?

Speaker: Ron Lo, General Counsel at Symend

Room: Rhythm 2

|

|

Session #3: Commercial Credit Ideas and Innovations

This session will provide the attendees with an understanding of where the industry is currently at, what tools/capabilities are available, and what are the coming innovations. You will learn how AI/ML has already impacted credit scoring, and what the market is likely to look like over the next few years.

Learning Objectives:

- Current state of the credit scoring market

- Innovations/future developments of the credit scoring market

Speaker: Stewart Webster, Director, Credit & Risk Solutions at S&P Global Market Intelligence

Room: Rhythm 3

|

|

11:15 am – 11:30

|

Break

|

|

11:30 am – 12:30 pm

Room: Waterbury

|

General Session: Collections Power Hour

Roundtable moderated by Sir Guy Epps, Senior Director Collections at Comcast Communications

Speakers: Anders Wallin, Sales Senior Director at C&R Software; Kelly Paul, Senior Director, Client Experience at True Accord; Michael Hawk, VP, Diversified Markets: Communications Vertical at TransUnion; Gordon Beck, President and COO at Valor Intelligent Processing

|

|

12:30 pm – 1:30 pm

|

Lunch

Room: Waterbury

Newcomers Lunch by Invitation Only

Room: Oakley (4th Floor)

|

|

1:30 pm - 2:45 pm

Room: Lagniappe

|

Speed Dating Networking Event for Business Affiliates and Voting Members

|

|

2:45 pm – 3:00 pm

Room: Waterbury Foyer

|

Refreshment Break

|

|

3:00 – 4:00 pm

Room: Waterbury

|

General Session: Credit Power Hour

Roundtable moderated by Maggie Whitaker, Director, Strategy & Analytics at Cox Communications

Speakers: Tara Bryant, Sr. Director Strategic Analytics at Equifax; Bob Guy, Data Solutions Consultant at Experian; Kevin King, VP Market Planning, Credit Risk at LexisNexis Risk Solutions; Zak Alvarez, Director - Research and Consulting at TransUnion

|

|

4:00 pm – 4:15 pm

Room: Waterbury Foyer

|

Refreshment Break

|

|

4:15 pm – 4:45 pm

Room: Waterbury

|

Member Meeting.

|

4:45 pm - 5:15

Room: Rhythms Foyer

|

End of Day TRMA Service Activity: Charity Sock Roll Session for NOLA Homeless.

|

|

6:00 pm – 8:00 pm

|

Evening Networking Event at Tin Roof. Apps and Drinks provided

226 Bourbon St, New Orleans (11 minute walk from the hotel) 226 Bourbon St, New Orleans (11 minute walk from the hotel)

|

Wednesday, March 6th

|

8 am – 9 am

Room: Lagniappe

|

Breakfast

Sponsored by:

|

|

9 am –9:30 am

Room: Waterbury

|

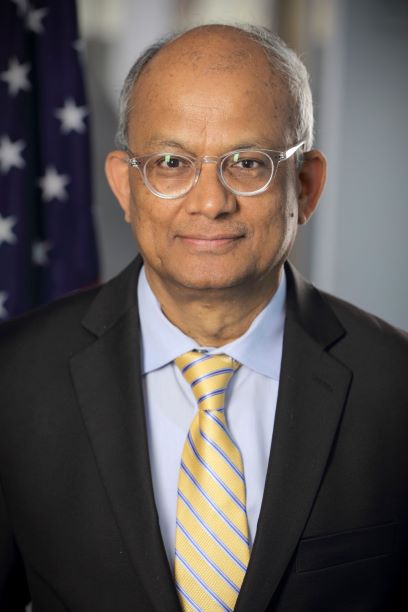

General Session: Welcome & CFPB Presentation

With K (Gandhi) Eswaramoorthy

Gandhi Eswaramoorthy is a Senior Program Manager for Debt Collections within the Consumer Credit, Payments, and Deposits Markets group of the Division of Research, Markets and Regulations at the Consumer Financial Protection Bureau. Prior to joining the Bureau in 2017, Gandhi has spent more than 25 years working on all aspects of credit card risk management including risk modeling, account management, collections and recovery policy and strategy at several large card issuing banks. Gandhi has a PhD in Agricultural Economics from Iowa State University, Ames, Iowa.

|

|

9:30-10:30

Room: Waterbury

|

General Session – Economic Update

Presented by Jesse Hardin, Risk Advisor - Equifax Risk Advisory Practice at Equifax

|

|

10:30 am-10:45 am

Room: Waterbury Foyer

|

Refreshment Break

|

|

10:45 am 11:45 am

Rooms: Rhythms 1-3

|

Breakout Sessions: Choose One

Session #1: Top Data Breach and Cybersecurity Risk Trends Report

Cybercrimes is one of the fastest-growing and most potentially damaging hazards that come with living in a digital age. In this session, we’ll review the state of cyber market trends and conditions, and how to prepare for the road ahead. We’ll delve into year-to-date breach statistics and trends including an overview of the current cyber threat landscape; predictions for 2023; and strategies for how to protect yourself and your business in an effort to mitigate risk.

Learn Objectives:

- Explore data breach and cybersecurity threat trends from the Experian 2024 Data Breach Industry Forecast,

- Give actionable insights on how to protect your organization and learnings on best practices.

Speaker: Michael Bruemmer, Head of Global Data Breach Resolution at Experian.

Room: Rhythms 1

|

|

Session #2: Navigate emerging digital trends while managing risk via robust authentication

Globally, fraudsters attack companies such as telecommunications providers three times more often than the average, according to data from the LexisNexis Digital Identity Network. Telecommunications companies face increasingly sophisticated fraud attacks and damaging financial losses.

To mitigate fraud and associated costs, while protecting consumers, telecommunications companies need more robust insights into global fraud patterns and a clearer understanding of consumer identity. Attend this session to discover how forward-thinking companies protect consumers and revenue, in-person and in digital channels:

- Discover ways to guard more effectively against sophisticated attempts at social engineering, scams, application fraud and account takeover attacks

- Gain insights to help improve fraud capture effectiveness with insights into billions of transactions from around the globe

- Learn how to provide seamless digital, hybrid and in-person experiences via a unified, end-to-end risk-based authentication approach

Learning Objectives:

- Understand how an authentication strategy can complement your organization’s priorities.

- Better balance customer experience with fraud detection in the authentication phase of the customer journey.

Speaker: Krystal Brown, Solutions Consultant at LexisNexis Risk Solutions

Room: Rhythms 2

|

|

Session #3: Collecting Loyal Customers – A Global Perspective

Around the world, one thing is true - the service a customer receives during collections plays a crucial role in customer retention. It is an often overlooked opportunity to delight your customers, even offering them a helping hand when they may be most in need of one. In this session, we’ll discuss what it means to put customers at the heart of your collections process and how that compares to other global organizations.

Learning Objectives:

• Understand how to humanize and personalize the collections journey

• Learn how other global organizations are collecting loyal customers

Speakers: Jeremy Russell (US) and Richard Drake (UK), Regional Sales Directors at C&R Software

Room: Rhythms 3

|

|

11:45 am – 12:15 pm

Room: Waterbury

|

Lunch Buffet served during last General Session

|

|

12:00 pm- 1:00 pm

Room: Waterbury

|

General Session: Fraud Power Hour

Roundtable moderated by Tim Maciejewski, VP, Global Growth at Authentic ID

Speakers: Clint Breithaupt, Sr. Fraud Manager at Charter Communications; Brian Newcomb, Director Credit Policy and Strategy at AT&T; Steve Craig, Founder & CEO, PeakIDV

|

|

1:00 pm- 1:15 pm

Room: Waterbury

|

Closing Remarks

|

Return to Top

|